Is there a statute of limitations on car repo in indiana? In indiana, the statute of limitations on the collection of credit card debt is six years.

7 Car-title-loans

A mortgage differs in essential particulars from a promissory note, bill of exchange, or other written contract for the payment of money of the same kind as.

Statute of limitations on car repossession debt in indiana. The statute of limitations is an affirmative defense to a lawsuit, so what that means is that if the credit card account was delinquent for more than six years at the time the lawsuit against you was filed, your attorney can have the lawsuit dismissed. It has not been five years from that date and lender may have already initiated legal action for the repossession process. The most common statute of limitation in indiana is two years.

You're right that the repossession is a form of collection but it is one that is not time barred by the statute of limitations. A negative notation on your credit report may remain for up to seven years if your loan is delinquent or up to 10 years if the notation is a vehicle repossession. Filing a bankruptcy is one of the few ways to stop the repossession.

Collection accounts can remain on your report for seven years and 180 days from the original delinquency. However, entering an additional agreement, either written or verbal, with the debt holder will reset the statute of limitations. The statute of limitations on debt in indiana varies, depending on the kind of debt it is.

In most cases, this means on the date of the last payment made. I am not 100% sure what you are asking. The statute of limitations on an debt in indiana.

Keep reading to find out. This timeframe is commonly referred to as the statute of limitations. The right of repossession does not require a lawsuit so there is no deadline on the right of repossession.

Paying the bank off is the other way to stop a repossession. Complete defense to colleciton action The 4 year statute of limitations is the deadline for filing a lawsuit.

The statute of limitations on such a suit for a breach of contract in michigan is six (6) years from the date of last payment, meaning many of our clients get sued two, three, or four years after their cars have been repossessed when they are in better financial shape. Your state might even prohibit deficiency judgments on car loans. Depending on the type of account and your location, this can be more than or less than the statute of limitations.

A “statute of limitations” refers to the amount of time a creditor has to file a lawsuit to collect an. Each state has its own statute of limitations on debt, and they vary depending on the type of debt you have. When they take you to court after those 6 years are up, you may be able to sue them for up to $1,000.

The statute may be triggered in this case when the statute accrued which would be when all payments were due and payable which by your description would have been in 2013. Depending on the kind of debt you owe, this period varies anywhere from two to twenty years. Aside from repossession issues, the creditor might have violated federal or state consumer lending, debt collection, and consumer sales practices laws in its dealings with you.

Usually, it is between three and six years, but it can be as high as 10 or 15 years in some states. No, there is no statute of limitation on repossessions. Lenders and debt collectors only have six years to take you to court on a debt.

Thanks for sharing your collection story with us. If the car was purchased using a retail installment sales contract, and the dealer arranged the financing, then the statute of limitations runs four years after the car is repossessed. If you are asking for the statute of limitations on a car loan in indiana, my sources indicate it is ten years.

The statute of limitation (sol) for purchase of goods (includes autos) falls under the ucc as 4 years from the date of the breach. The statute of limitations inindianafor a judgment is 10 years unless renewed by the collector. That means once a creditor has a judgment against a consumer, that judgment is collectible for up to 10 years.

The actual statute of limitations in georgia is officially 4 years. However, the georgia court of appeals came out with a ruling on january 24, 2008, that indicates that it’s 6 years on a credit card. Late payments, for example, can stay on your report for seven years from the original delinquency.

The junk debt buyer who is calling you (but hasn't sued) is trolling for a voluntary payment on a debt which should either be rolling off your. A debt collector may extend the time in which it can collect a debt from a consumer by obtaining a judgment. Indiana has a specific time frame that creditors can pursue lawsuits for debts.

It's in indiana and it's a 2006 hummer. But debt collection statutes of limitation based on contracts are longer. Once the loan is defaulted on and the bank holds a lien on the title, they may repossess the vehicle at any time they feel it is to their financial benefit to do so.

The creditor might have waited too long to pursue the deficiency judgment, violating your state's statute of limitations. Indiana statute of limitations on debt; Personal injury claims in indiana are generally barred (subject to dismissal) if they are not filed two years from the date of the injury.

The statute of limitations becomes effective on the date of the last activity on an account. You may be wondering if the statute of limitations has lapsed on your debt.

Indiana Auto Repossession Laws

Indiana Auto Repossession Laws

Indiana Auto Repossession Laws

Man Says Indiana Statute Of Limitations Puts His Debt Off-limits - Top Class Actions

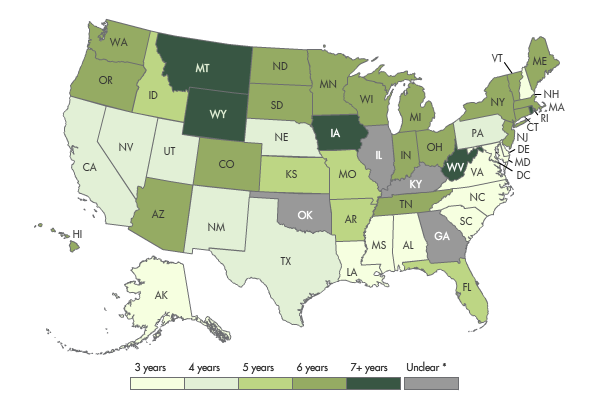

Statute Of Limitations On Debt Collection By State - Lexington Law

Can An Auto Lender Pursue A Deficiency Judgment After A Repossession Chicago Auto Loan Collections Lawyer

Indiana Auto Repossession Laws

Indiana Auto Repossession Laws

Statute Of Limitations On Debt Collection By State - Lexington Law

Indiana Auto Repossession Laws

What Is The Statute Of Limitations On Debt In Indiana

/state-by-state-list-of-statute-of-limitations-on-debt-960881-17dca963dbe14826877ea1e67a87451e.jpg)

Debt Statutes Of Limitations For All 50 States

What Are The Repossession Laws In Indiana Learn About Repo Laws In In

What Is The Statute Of Limitations On Debt In Indiana

Indiana Auto Repossession Laws

If A Car Is Repossessed Do I Still Owe The Debt Solosuit Blog

Statute Of Limitations For Debts Credit Cards Judgments

Can You Get Your Car Back After Repossession In Indiana Repo Lawyer

What Is The Statute Of Limitations On Debt In Indiana

Komentar

Posting Komentar